(Hypebot) — Spotify’s Discovery Mode announcement looked at the very best a poorly timed announcement, coming at a time when artists and songwriters are more concerned about their income than at any other since the music business returned to growth more than half a decade ago.

If the initial responses of the creator community are anything to go by, the announcement has had the effect of taking the broken record debate, breaking it some more, and turning it into the pulverized record debate. Yet, judging the impact of the announcement on the creator community alone misses the wider strategic worldview that Spotify operates within, and understanding why Spotify would make such a move now.

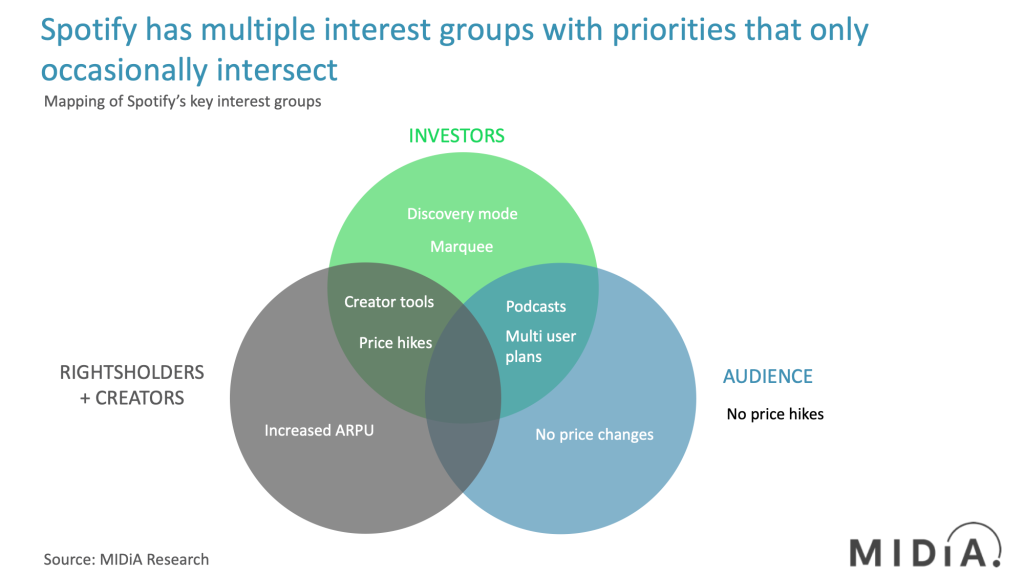

Spotify has three competing interest groups:

- Investors

- Audiences

- Rightsholders and creators (a group which it sometimes splits, for example with its temporarily aborted Direct Artists move)

It has to keep all three happy or it does not have a business. As it gets bigger and more established, however, it feels that it can afford to make moves that may antagonise rightsholders / creators and audiences but that will keep investors happy. The logic is that Spotify is getting so big that those two audiences cannot do without it (the ‘too big to fail’ stage) but that investors have many other places to put their money. So, investors are more ‘at risk’ than the others.

The new normal

As we discussed last week, since going public Spotify has told investors to measure it on growth and market share rather than margin or average revenue per user (ARPU). This clearly serves the investor segment better than rightsholders and creators. Now, however, as it embarks on a long-term podcast strategy that will not see full return on investment for many years, Spotify needs to show investors that it is able to turn its core music business into a profitable one. Price increases, which it kicked off last week and Daniel Ek trumpeted in his investor note, are key to this. The strategy delivers benefits for both investors and rightsholders / creators, though goes against the interests of the audience, which will always prefer to pay less, not more.

Audiences are at the back of the queue

Though they are very different propositions, Discovery Mode, along with Marquee, have the similar effect of improving profitability but have the consequence of reducing the net amount of income that goes back to rightsholders because they are spending more of their income on marketing. They shift the ‘balance of trade’ between Spotify and rightsholders and creators. This will also mean more deductions for creators, which in turn means less streaming income.

Thus, these tactics are primarily focused on appeasing the investor segment. Interestingly, both are actually negative for the audience, damaging the user experience by delivering music that has paid its way into a user’s listening rather than solely because it matches the user’s tastes. Spotify has long positioned itself as an alternative to radio but is becoming ever more like the very thing it is trying to replace. It is making the assumption that it is so entrenched with its users that it can afford to make such moves without risking losing audience. Apple, Amazon, Google and Deezer will be running their hands with glee.

The next Spotify chapter

We are entering the next chapter in Spotify’s story. Podcasts will take centre stage, while the core music business is treated as a mature subscription business rather than a growth category – at least in Western markets. The underlying tactics are aimed at improving investor sentiment but will deliver long sought benefits to rightsholders / creators, not least improved ARPU and per-stream rates. Interestingly, podcasts could improve per-stream rates too: if podcasts steal music time (which they will) but the royalty pot remains set at its current share, then there will be fewer streams to share the royalty pot between. Hence, higher rates.

Increased royalty income but a bumpy road

The net impact of this new strategic direction will be beneficial for investors first and rightsholders / creators second. On balance, the impact of increased prices, fewer promotions and increased lifetime value should offset the impact of efforts like Marquee and Discover Mode. Rightsholders and creators should see a steady increase in rates in Western markets. However, they should not expect to be happy with everything Spotify does, as this is first and foremost about pleasing investors. Do not expect Discover Mode to be an isolated event.