(Hypebot) — Music streaming subscriber growth rates are slowing, but not for SiriusXM. In addition to satellite broadcasting, its streaming app is a legitimate contender, and despite some decline, sister service Pandora remains a leader among ad-supported music services.

by Russ Crupnick of Music Watch

It was a challenging first quarter for Sirius, with staff reductions and a notable dip in stock price. New vehicle sales, which typically fuel trials of Sirius’ in-car satellite service, have been in the doldrums since the start of the pandemic. COVID altered driving and especially commuting patterns, impacting all in-vehicle audio listening.

While most analysts look at the financials, MusicWatch studies the consumer landscape for audio. Using consumer surveys, MusicWatch is continually taking the pulse of audio listeners in the United States. From that perspective you would conclude that Sirius is well positioned to grow its subscriber base, and to compete with the big dogs of audio streaming.

Our research shows a recovery in Sirius listening hours, thanks to people getting back into cars post-COVID, or at least post the worst of COVID. Broadcast radio remains the leading mode of listening in vehicles. Sirius provides an alternative to broadcast radio for its audience, but it is time to stop thinking of satellite radio as just that.

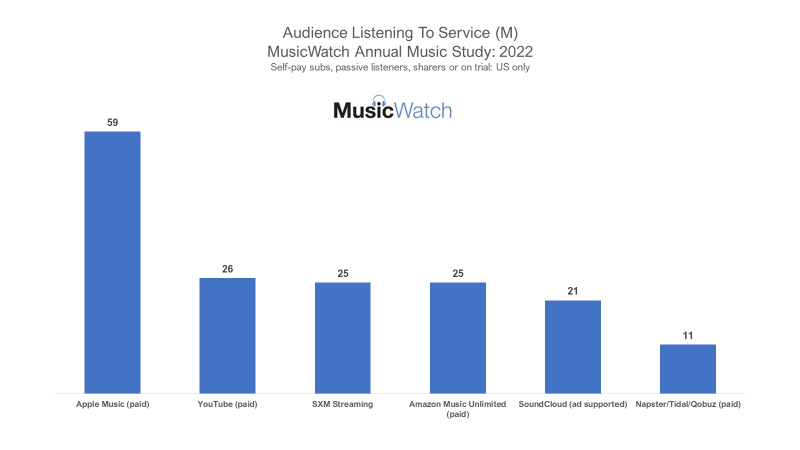

Conversation about Sirius shifting from a purely satellite based service to a blended option including streaming misses the point. Sirius is already a capable competitor to the major music streaming services. MusicWatch estimated that Sirius has over 60 million listeners*, or nearly two listeners for every subscriber. Similar to services such as Spotify or AppleMusic, there is the person who subscribes, and others who share the account- through using the same vehicle, or riding in it. An estimated 25 million stream Sirius using the SXM app. To put that into perspective, the 25 million SXM streamers represent about the same audience who listen to YouTube Music (the paid version with 26 million listeners), Amazon Music Unlimited (25 million), SoundCloud (21 million) and more than Tidal, Napster and Qobuz combined.

Getting back to the car, we’re on the cusp of major changes in our automobiles. It will take some time as the average age of cars is 12 years, but the legacy radio business is in full go-mode to slow or prevent the removal of AM/FM radios in the car. The #1 reason motivating streaming subscribers to pay for their service is not music discovery or playlists. It is ease of use in their vehicle. And isn’t Sirius already there, regardless of whether it is in the dashboard or connected through the SXM app? Averages also don’t tell the story. The average car may be more than a decade old, but the higher socioeconomic subscriber is more likely to own a newer vehicle or a vehicle with premium “center-stack” capabilities. That may benefit all of the streaming audio services, but Sirius also has sports, news, and other added value content.

MusicWatch and other reputable sources such as RIAA and IFPI have noted that growth rates for paid streaming are slowing in the US. Three out of four paid on-demand subscribers are Millennials or younger. However, more growth in music subscriptions has been coming from the older demographic in recent years. Sirius has traditionally targeted that older audience; those who pined for a better “radio” experience in the car, and who were willing to pay for it. If you’re in GenZ you are 15 times more likely to have a subscription to Spotify or other music services than you are to Sirius. But that gap narrows to a bit more than two to one among GenX and Sirius actually wins among Boomers. With a blended satellite/streaming offering you could argue that Sirius is well positioned to wring out the untapped potential of the 40 plus demographic. And perhaps begin to convert younger listeners interested in comedy, sports or talk programming.

Some analysts have expressed concern about audio services being canceled due to unfavorable economics. MusicWatch research conducted in 2022 noted that there was very little risk of churn for audio services, including among Sirius subscribers. Top reasons for retaining a Sirius subscription included using it all of the time, using it everywhere, good value for the fee, and its role in facilitating music discovery.

Pandora is a major asset. Despite all of the attention garnered by the on-demand services, ad-supported internet radio continues to attract an audience of over 100 million listeners. One in four US internet users over the age of 13 listened to Pandora in 2022. The over 40 crowd prefers ad-supported internet radio for music to free on-demand. Despite the growth in paid subscriptions for audio, there remains a large audience who exclusively use ad-supported options. Among those preferring ad-supported audio, Pandora continues to be a leader. Ad revenue forecasts, important since Pandora sources 75 percent of its revenue from advertising, are generally bullish on audio spend, including for podcasts. Pandora may not enjoy the position it held in the early days before Spotify or AppleMusic burst onto the scene, but it is still a foundational piece of the streaming audio industry.

While the spotlight is frequently on other players, and even on TikTok, Sirius is gaining momentum as a player in the streaming side of audio. Its legacy advantages in the dashboard are increasingly complemented by “SXM Everywhere” capabilities. While Millennials have represented the traditional sweet spot for music subscriptions, GenX and Boomers are a much larger, and perhaps more untapped, audience. Frankly, Pandora doesn’t get the respect it deserves based on the numbers.

Pivotal Research, a Wall Street firm, had a cloudy short-term outlook for SIRI based on subscriber forecasts, vehicle sales and investments required to upgrade the streaming platform. But they were positive long-term. Looking at the numbers from a listener perspective, you’d have to agree.

*Listeners estimates are based on MusicWatch projections from its Annual Music Study completed January 2023. Listeners include the spectrum of a service’s audience; self-pay subscribers, those with family plan access, those who share account log-ins, passive listeners and those on a trial to the service.