(Hypebot) — MIDiA has released its annual “Current State of the Music Creator Economy” report, the definitive assessment of the music creator tools industry, and here they share the highlights.

via MIDiA

MIDiA is excited to announce the publication of the latest edition of its annual ‘State of the music creator economy’ report. Based on months of research, MIDiA creator and consumer surveys, market sizes and forecasts, this report is the definitive assessment of the music creator tools industry. [The report is available to clients here.]

The Highlights

The pandemic triggered a surge in the music creator economy, bringing an influx of interest and investment. Suddenly, everyone was talking about music creator tools while investors ploughed investment into leading companies, like Native Instruments and Splice, while newer entrants, like LANDR, carved out new models.

By 2022, the industry found itself in a post-pandemic lull – always a possibility, even before the subsequent cost-of-living crisis. But, as our report reveals, the slowdown does not represent a sector returning to a pre-inflated level, but instead, a natural rebalancing before long-term, dynamic growth kicks in. This is because the pandemic did not create the market but catalyzed an already growing sector driven by a new wave of creators focused on simplicity and efficiency. The pandemic compressed three years of user growth into one and a half years, so slowing revenues are, in large part, a reflection of the bedding in of this cohort.

But it is post-pandemic trends that will grow the market most: a) the rapid rise of AI, and B) the rise of the consumer-creator. Consumer-creators transformed photography (Instagram) and videography (TikTok); music will be next. Not only will casual music creation become mainstream, it will trigger an unprecedented widening of the music creator economy funnel. So the market’s future will be defined by:

- Simplification

- Consumerization

Perhaps the clearest sign that the music creator space continues to grow at pace, despite lackluster results from some key companies, is that the number of creators grew by 12% to reach 76 million, with the number of those who upload their music growing by more than double that rate. Interestingly, the number of artists who self-release into the traditional streaming supply chain grew at half this rate. A forking of the music business is taking place before our very eyes, with the streaming ecosystem playing the traditional establishment, and social apps and new platforms, like BandLab, representing a new, future-facing, creator-centered ecosystem.

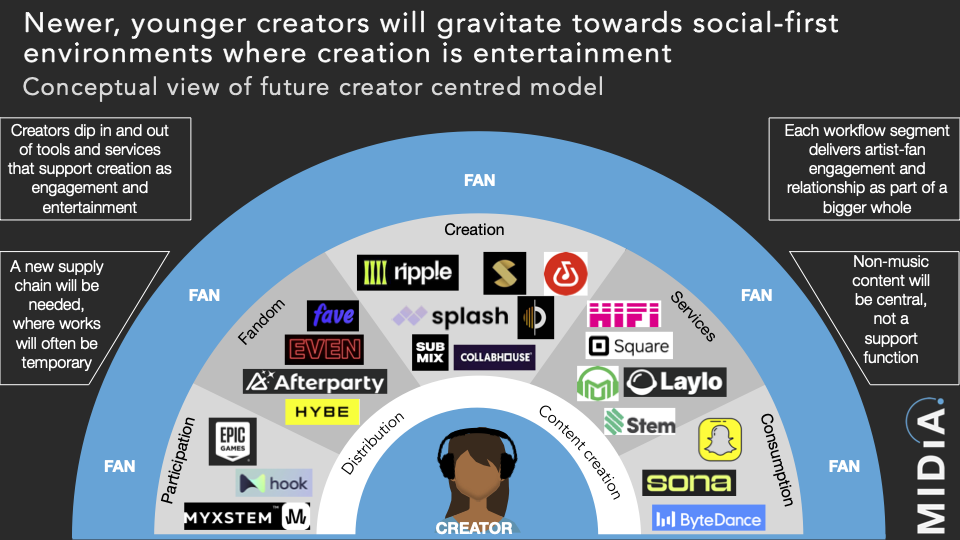

Humans like to think of history in chapters, and music is no different – sorted into neat sections: the CD, piracy, downloads, streaming. We are now entering the creator era. A paradigm shift that will see the creator become center stage, with creation itself being entertainment, and fans being given ever-more ways to participate and create themselves.

The new, post-streaming models will be defined by characteristics that are almost mirror opposites to the DSP model:

- Creator-centric versus rights-centric

- Creation versus consumption

- Dynamic versus static

- Non-linear versus linear

- Fans versus audiences

The streaming-centered music business and creator tools used to be separate industries but they are now becoming part of one, extended value chain. With revenues of nearly six billion in 2022, and rising to $10 billion by 2030, the creator tools sector is going to have both commercial and cultural transformational impact. Though hardware will continue to be a crucial part of the market, creation is becoming increasingly virtual, software, sounds and services will account for the majority of future growth.

The growth of the creator tools market to date has resulted in a surge of new tools and services. In fact, there are too many, making it hard for creators to identify what they need and why. Cloud services, such as the recently launched FL Cloud, which combine multiple tools to create joined-up workflows, are a new and important part of the market. This reaggregation approach will become far more prevalent, with subscriptions gaining share, up from a quarter of software, sound and services revenues in 2022, to nearly a third in 2030.

AI will, of course, also be a key growth driver, building on an already long history in creation. Current music AI tools cluster around three groups:

- Assistive tools

- Generative creator tools

- Generative consumer tools

Established creators will increasingly use generative tools as sound sources, but they will play a more foundational role for younger, newer creators. AI’s biggest impact will be its opening up of the consumerization of music, which itself will comprise of three key components:

- Voice

- AI

- The phone

The days of audience, creation, rights and distribution being discreet sectors are numbered. Creation is going to become the linking element, with a new generation of fast-moving creators opting into new models that enable them to operate across all elements simultaneously. The shift of cultural capital will be industry-changing and, in this context, ByteDance launching its creator tools, Mawf and Ripple, demonstrates it is staking its claim to be a key player in this brave new world.

Even though this post covered a lot of ground, it is only a tiny fraction of the 7,000 word, 46 page, 18 figure report! It includes four sections, covering:

- Music creators

- AI

- Market size

- Future models

With deep data on music creators, consumer creators, market sizes and forecasts, AI vendor mapping and future business models, there is simply no other report you need to understand both the creator tools market and its growing influence on music business and culture.

If you are not yet a MIDiA client and would like to learn more about how to become one, email stephen@midiaresearch.com.

Finally, here is a list of the companies and brands mentioned in the report: Ableton, Amp, Apple, Arturia, Audiocipher, Avid, BandLab, Bandzoogle, Beatclub, BeatStars, Boomy, ByteDance, CD Baby, Coursera, Discord, Discovery Mode, Distrokd, Fender Play, Final Cut Pro, Fiverr, Focusrite, FL Cloud, FL Studio, FRTYFVE, Google, HIFI, IK Multimedia, Image-Line, Instagram, iZotope, Jamahook, Korg, LALAL.AI, LANDR, LANDR Network, Linkfire, Live, Logic, Loopcloud, MasterClass, Mawf, Meta, Moises, Moog, Native Instruments, Neutron, Pandora, Ripple, Roland, SongStarter, SoundBetter, SoundCloud, Songtradr, Spitfire Audio, Splice, Spotify, Stem, Submix, Suno Chirp Bot, Symphony OS, TB303, TikTok, Tracklib, TuneCore, United Masters, Waves, Yamaha, YouTube, YouTube Shorts