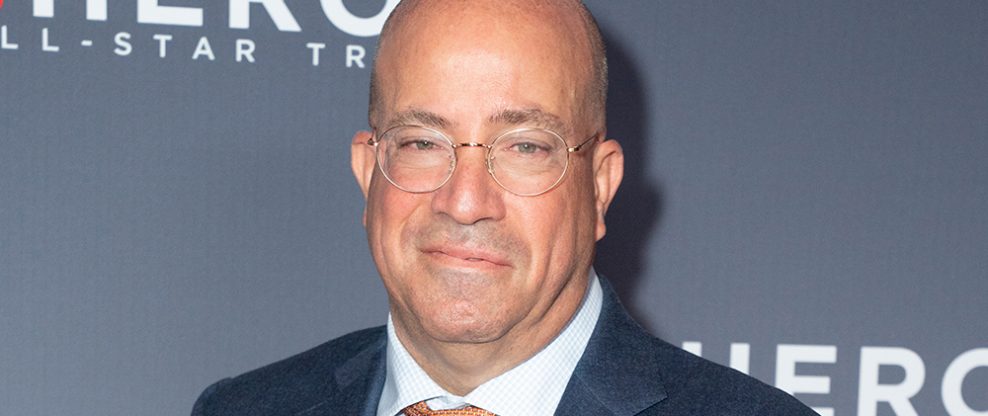

NEW YORK (CelebrityAccess) — Media executive Jeff Zucker has partnered with RedBird Capital and International Media Investments to launch RedBird IMI, a new investment vehicle seeking to acquire and invest in “large scale” media, entertainment and sports properties.

RedBird IMI launches with an initial war chest of $1 billion to pursue their acquisition strategy on a global basis, the companies said.

Jeff Zucker will serve as the Chief Executive Officer of the new venture as well as an operating partner.

“I’ve spent 35 years running media businesses at the intersection of news, sports and entertainment, creating new brands and resurrecting old ones. That experience has given me unparalleled perspective for this unique time in media, and the combination of the RedBird and IMI capital and strategic discipline, combined with my operational experience, will give this joint venture a unique advantage in the current media landscape,” Zucker said in a press statement announcing the new venture.

Zucker most recently served as the CEO of cable news network CNN, a post which he held since 2013 but from which he abruptly stepped away from in February. He also served as President of Turner Sports from 2019 to 2022 and spent 25 years at NBC Universal, including a stint as the media conglomerate’s CEO from 2007 to 2011.

“The RedBird IMI joint venture has come together at an important time as the media industry continues to evolve in both content creation and distribution to meet the evolving expectations of consumers globally. Partnering with Jeff Zucker and Gerry Cardinale will enable us to bring tremendous operational, investing and financial expertise to make impactful and transformative investments across the media, entertainment and sports landscapes.”

The deal will expand on RedBird’s existing portfolio, which already includes multiple sports properties such as Fenway Sports Group, a global sports, marketing, media, entertainment, and real estate platform anchored by the Boston Red Sox and the Liverpool Football Club, as well as Fenway Stadium and Anfield Stadium, Fenway Sports Management.

The company also has a stake in the NFL’s hospitality division, On Location Experiences, and the would-be National Football League rival, the NFL.