(Hypebot) As the Chinese company Tencent Music Entertainment preps for their initial public offering, Robert Lyon takes a moment to look more closely at the country’s digital music industry, and what the rest of us can learn from Tencent’s success in such a challenging market.

_____________________________

Guest post by Robert Lyon, Music Law, from the Berklee College of Music, Music Business Journal

“The future is already here. It’s just not evenly distributed”

William Gibson, science fiction author

At this writing, Tencent Music Entertainment is planning an initial public offering (IPO) and has filed documents with the Securities and Exchange Commission. This company, spun off from parent Tencent Holdings Ltd., is the major music streaming company in China, and their IPO is a timely reminder that China’s digital music industry merits a closer look for insights into the possibilities for global digital music.

Background:

China’s music streaming market is remarkable on several fronts, including the vast size of the market,1 the high percentage of use of mobile devices for music (67% versus 48% in the US)2, high smartphone penetration (92 cellular subscriptions per 100 people versus 117 in US),3prevalent mobile cell coverage (in urban areas),4 and aggressive government funding for an upgraded and expanded mobile broadband; claiming over one billion 4G subscriptions.5

Despite this, China’s recorded music revenues are disproportionately small, even when compared to much less populous countries. These low revenues reflect many factors, including the low fees paid to rights holders (typically music labels and publishers), a low adoption rate of the subscription model, but perhaps most crucially, the historically weak copyright environment in China’s modern era. A poor copyright environment created opportunities for non-music companies to enter the digital music space. For example, Baidu, the giant search engine with over 80% market share in China, built a massive audience, helped significantly by offering search returns with deep-links to free unlicensed mp3s. 6

Other companies built a massive online audience in other non-music verticals, notably Alibaba in e-commerce and Tencent in gaming and social messaging. In a low intellectual property enforcement environment these companies offered music to entice customers to their platform, and as the competition for platform market share intensified, music has become increasingly important. Through acquisitions, mergers, and investments, Tencent Holdings Ltd. has come to control the three largest music streaming services, which collectively control 78% market share in China,7 as well as exclusive licensing deals with major music labels. 8

Intellectual Property:

Music piracy was rampant in China during the CD era, with large scale infringement against both local and global rights owners. However, over the last 10 years, and particularly since 2015, there have been increasingly effective efforts by both government and industry in China to improve and enforce copyright legislation and the collection of digital royalties.

One notable instance was the creation of the Alliance of Digital Music Industry, formed in July of 2011, by China’s Ministry of Culture. This group is comprised of nine music companies, thirteen websites, and three wireless operators, all committed to abide by new Chinese laws and regulations designed for content providers such as Labels and Service Providers, to more easily negotiate price and profit-sharing mechanisms.9

More recently the government undertook an anti-piracy campaign “Sword Net 2015.” This action by NCAC (National Copyright Administration of China), set a July 2015 deadline for all Chinese music services to take down their catalogs of unlicensed songs, then promptly removed 2.2 million unlicensed songs.10 Also significant is the fact that China’s copyright laws are currently in the process of being amended for the third time since first being drafted in 1990.11

To appreciate this transformation of the Chinese Intellectual Property environment, it is useful to contrast it with the vastly different US starting point. The first copyright laws in the US took force with the First Congress in 1790 under the US Constitution (Article 1, Section 8), while the PRC’s first copyright laws were enacted 201 years later in 1991. In 1976, as the US Congress was updating IP law with the Copyright Act of 1976, China was just emerging from the Cultural Revolution, a context in which private property was a crime, and innovative work did not belong to the author, but to the “collective endeavor” behind the author.12 The extent and dramatic pace of this transformation cannot be overstated.

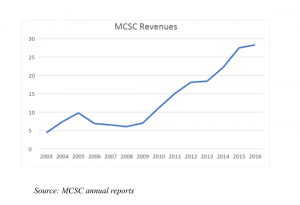

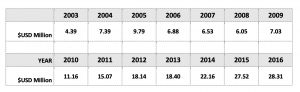

At the present time, the agencies tasked with collecting digital streaming royalties, such as Music Copyright Society of China (MCSC) and the China Audio Visual Copyright Association Society (CAVCA), are still small stakeholders in the overall industry ecosystem, but the trajectory has been clear. Revenues from music streaming from 2012 through 2016 increased 56%, a compound annual growth rate of 11.7%.

As impressive as this rate of growth is, it is useful to bear in mind that the 2016 revenues were roughly $28.3 million, only about 1% of the $2.68 billion in revenues collected that year by ASCAP, BMI and SESAC. 13

One way to view this would be that the MCSC collections are a tiny amount relative to other large markets. But it can also be seen as evidence of the potentially massive revenues that could be realized as copyright enforcement increases and collection mechanisms improve.

The Competitive Landscape:

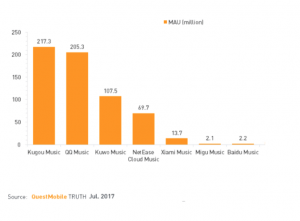

Due to aggressive horizontal and vertical integrations, Tencent has emerged dominant in the music streaming space. Tencent owns the most popular social media platform in China, Weixin (菓斤),better known as WeChat, which has an estimated 800 million users. Tencent also has created massive communities around gaming, streaming, e-payment, and QQMusic (named after Tencent’s original messaging service, QQ), is the second largest music streaming service. Tencent acquired the #1 and #3 music services, Kugou and Kuwo, when it bought majority stakes in their parent company, China Music Corporation (CMC) in 2016.14

These three streaming Tencent-controlled services companies comprise 78% of the Monthly Average Users of music streaming in China. Other leading services include: Wangyi or Netease, a company with origins as a gaming platform; Xiami, owned by e-commerce giant Alibaba and Baidu Music, owned by search giant Baidu. These services typically offer multiple paid tiers with various benefits, in addition to their free and ad-supported services.15

As part of the battle for market share, the three largest companies, Baidu, Alibaba, and Tencent (aka BAT) seek to integrate music into their platforms. This aligns with predictions for the global music industry made by Marc Geiger in a 2014 Keynote at MIDEM. A longtime high profile music industry executive and current Head of Music at William Morris Endeavor, Geiger predicted that music streaming companies would be acquired by large online platforms with “hundreds of millions of users, not tens of millions,” and that music streaming would increasingly shift to a subscription business model. He likened today’s Western streaming companies such as Spotify and Pandora to the early companies of the world wide web, such as Altavista and Lycos— pioneers who would end up disappearing in the wake of consolidations and fierce competition among platforms with massive scale.16

In many ways, this has already happened in China. The 530 million users of Tencent’s music apps (QQ Music, Kugou and Kuwo) comprise 78% of music streaming, as described above. The company Netease expanded from its origins in PC and mobile gaming to successfully leverage its expertise in real-time social interaction by creating Netease Cloud Music, launched in 2013. Netease is now the fourth largest service, with nearly 70 million monthly average users (MAU). Alibaba’s Xiami offers music streaming services for about 14 million customers. Baidu’s dominance of search allows it to offer its music streaming services to hundreds of million search customers, resulting in 2.2 million MAU.17

Business Models:

At this writing, shortly before their IPO, Tencent Music Entertainment’s (TME) filing documents declared profits of $263 million, from revenues of $1.3 billion, and an expected value of $25-$30 billion. Meanwhile Spotify’s financials report current revenues of $5.3 billion, a net loss of -31.3% , and a market cap of $29.5 billion. TME reported a 20.2 % profit margin in the first six months of this year and 11.7% margin for 2017, while Spotify has yet to earn any profit.

These numbers throw their differing business models into sharp relief. Spotify relies on subscriptions for 90% of its revenue, with 10% coming from ads. By contrast, TME earned 70% of its revenues on music-centric social media activity—chiefly the percentage it keeps from “virtual gifts,” or a user’s direct cash donations to live streaming app performers. This form of interaction is nearly unknown in the West, but enormously popular in China. The Chinese PROs are beginning to take notice. In 2017, MCSC filed a 300,000 yuan ($44,000) lawsuit against one of the leading live stream platforms, Huajiao Live Stream, for use of un-licensed content performed in their live streams, which ended with Huajiao signing a licensing agreement with MCSC.18 This is another example of the improvement of music copyright enforcement underway.

Conclusion:

Music copyright in China is relatively new, enforcement is still imperfect, and it lacks the long-standing structures and robust enforcement of the West. But there is a clear trajectory towards enforcement, compliance and revenue growth. There is also innovation of business models beyond the binary choice of ad-supported freemium and subscriptions.

Given the improving IP environment, vigorous mobile platform competition, the adoption of subscription music streaming by large online companies, and robust mobile consumption, the music streaming landscape in China offers a glimpse into a future that some (including industry experts like Geiger), believe to be coming. Varied business models, application-layer innovations and integration with social, e-payment and other platform functionalities may well portend future developments among western music streaming companies; both those that dominate now and potential new entrants, possibly from non-music industries.

Acknowledgements: Thanks to Dr. Zhang Fengyan of Communication University of China, and Doctoral Candidate Tang Diming of Edinburgh University for their kind assistance.

Endnotes:

1 China: Mobile Subscriptions by Month 2018 | Statistic.” Statista. Accessed July 16, 2018. https://www.statista.com/statistics/278204/china-mobile-users-by-month/

2 “Consumer Barometer from Google.” Consumer Barometer. Accessed July 16, 2018. https://www.consumerbarometer.com/en/graph-builder/?question=W8&filter=country:china,united_states

3 “Mobile Cellular Subscriptions (per 100 People).” GDP Growth (annual %) | Data. Accessed July 16, 2018. http://data.worldbank.org/indicator/IT.CEL.SETS.P2?end=2015&locations=CN&start=1960&view=chart

4 “Coverage Maps.” State of Mobile Networks: Brazil – OpenSignal. Accessed July 16, 2018. https://opensignal.com/networks.

5 “China Breaks 1B 4G Subscriber Mark.” Mobile World Live. January 23, 2018. Accessed July 16, 2018. https://www.mobileworldlive.com/featured-content/home-banner/china-breaks-1b-4g-subscriber-mark/

6 Orlowski, Andrew. “China’s Nonstop Music Machine • The Register.” The Register® – Biting the Hand That Feeds IT. Accessed July 16, 2018. https://www.theregister.co.uk/Print/2008/09/13/baidu_investigation/

7 Tang, Diming, and Robert Lyons. “An Ecosystem Lens: Putting China’s Digital Music Industry into Focus.” Global Media and China1, no. 4 (2016): 350-71. doi:10.1177/2059436416685101

8 “Tencent Expands Music Streaming Business with New Universal Pact.” South China Morning Post. May 16, 2017. Accessed July 16, 2018. https://www.scmp.com/tech/china-tech/article/2094571/tencent-expands-music-streaming-business-universal-music-group-pact

9 Dong, Xue, and Krishna Jayakar. “The Baidu Music Settlement: A Turning Point for Copyright Reform in China?” SSRN Electronic Journal, 2012. doi:10.2139/ssrn.2031579

10 Tang, Diming, and Robert Lyons. “An Ecosystem Lens: Putting China’s Digital Music Industry into Focus.” Global Media and China1, no. 4 (2016): 350-71. doi:10.1177/2059436416685101

11 Zhang, Fengyan, “The Status of Chinese Music Industry and the Potential Influence of the Third Amendment of Chinese Copyright Law” Presented at the Music and Entertainment Industry Educators Association(MEIEA) Summit, Chicago, Ill. April, 2017\

12 Yu, Peter K. “The Second Coming of Intellectual Property Rights in China.” Texas A&M Law Scholarship. Accessed July 18, 2018. https://scholarship.law.tamu.edu/facscholar/1024/.

13 “A Comprehensive Comparison of Performance Rights Organizations (PROs) In the US.” Digital Music News. March 28, 2018. Accessed July 18, 2018. https://www.digitalmusicnews.com/2018/02/20/performance-rights-pro-ascap-bmi-sesac-soundexchange/

14 Tang, Diming, and Robert Lyons. “An Ecosystem Lens: Putting China’s Digital Music Industry into Focus.” Global Media and China1, no. 4 (2016): 350-71. doi:10.1177/2059436416685101.

15 Osawa, Juro. “Tencent Customers Come for the Music, Stay for the Perks.” The Wall Street Journal. June 09, 2015. Accessed October 13, 2018. https://www.wsj.com/articles/tencent-customers-come-for-the-music-stay-for-the-perks-1433869369.

16Midem. “Keynote: Marc Geiger, WME – Midem 2014.” YouTube. February 02, 2014. Accessed July 18, 2018. https://www.youtube.com/watch?v=bcNsAR

17 “QuestMobile – QuestMobile: 2017 China Music Apps Report.” QuestMobile – QuestMobile潳蕡报舠ㄩ腾讯PK网瘨ㄛ谁謢蒻真魦ˋ. Accessed July 28, 2018. http://www.questmobile.com.cn/blog/en/blog_111.html.

18 Osawa, Juro. “Tencent Customers Come for the Music, Stay for the Perks.” The Wall Street Journal. June 09, 2015. Accessed October 13, 2018. https://www.wsj.com/articles/tencent-customers-come-for-the-music-stay-for-the-perks-1433869369.