(CelebrityAccess) Science tech-y website Ars Technica recently published an article claiming the financial sheets show a whopping debt of $37 million for To The Stars Academy, the boutique UFO project launched by Blink-182’s Tom DeLonge last year, but apparently it is a case of misreading the numbers.

Eric Berger, the site’s senior space editor and Houston Chronicle veteran with a Pulitzer Prize nomination, wrote a Gonzo-style story about DeLonge, his book “Sekret Machines” and the musician’s interest in all things alien in which Berger notes that To The Stars Academy of Arts and Science, a think tank of UFO researchers and former intelligence officials, has racked up $37 million in debt in one year despite having only 11 employees. That was modified to deficit after DeLonge responded to the piece (but not before it was picked up by various news outlets).

“Tom DeLonge’s alien business has raised just over $1 million in outside funding,” the Ars Technica article said. “The company has racked up a $37.4 million deficit (originally “debt”), however, largely from a stock incentive plan for its employees. The financial filing states that To the Stars intends to remain in business over the next 12 months by selling additional stock. Their website says they accept credit cards, if you’re so inclined to help keep the effort afloat.

“I’m not sure what to say about a millionaire who parlays his or her fame into a business that raises funds from people who are not millionaires but desperately want to believe in aliens, or conspiracies, or hidden government technologies.”

“The approximate $37 million stockholders’ deficit is NOT DEBT as he (Berger) characterized it but is attributable to stock-based compensation expense. IT IS NOT RELATED TO THE OPERATIONAL RESULTS OF THE COMPANY,” DeLonge responded. “The Consolidated Balance Sheets of To The Stars Academy of Arts and Science in the SEC filing quoted by your author clearly shows the approximately $37 million deficit is attributed to Stockholders’ Equity (Deficit). The filing goes on to explain the mechanism for calculating stock-based compensation and details the various grants of stock options by the company.”

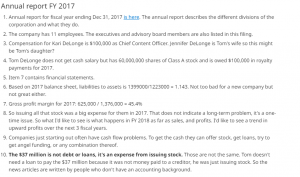

A post on Reddit by someone who claims to have four years experience in accounting and runs a small business looked at the financials and explained it the best he or she could.

“The $37 million is not debt or loans, it’s an expense from issuing stock. Those are not the same,” the Redditor says. “Tom doesn’t need a loan to pay the $37 million because it was not money paid to a creditor, he was just issuing stock. So the news articles are written by people who don’t have an accounting background.”

Some of the Reddit post: